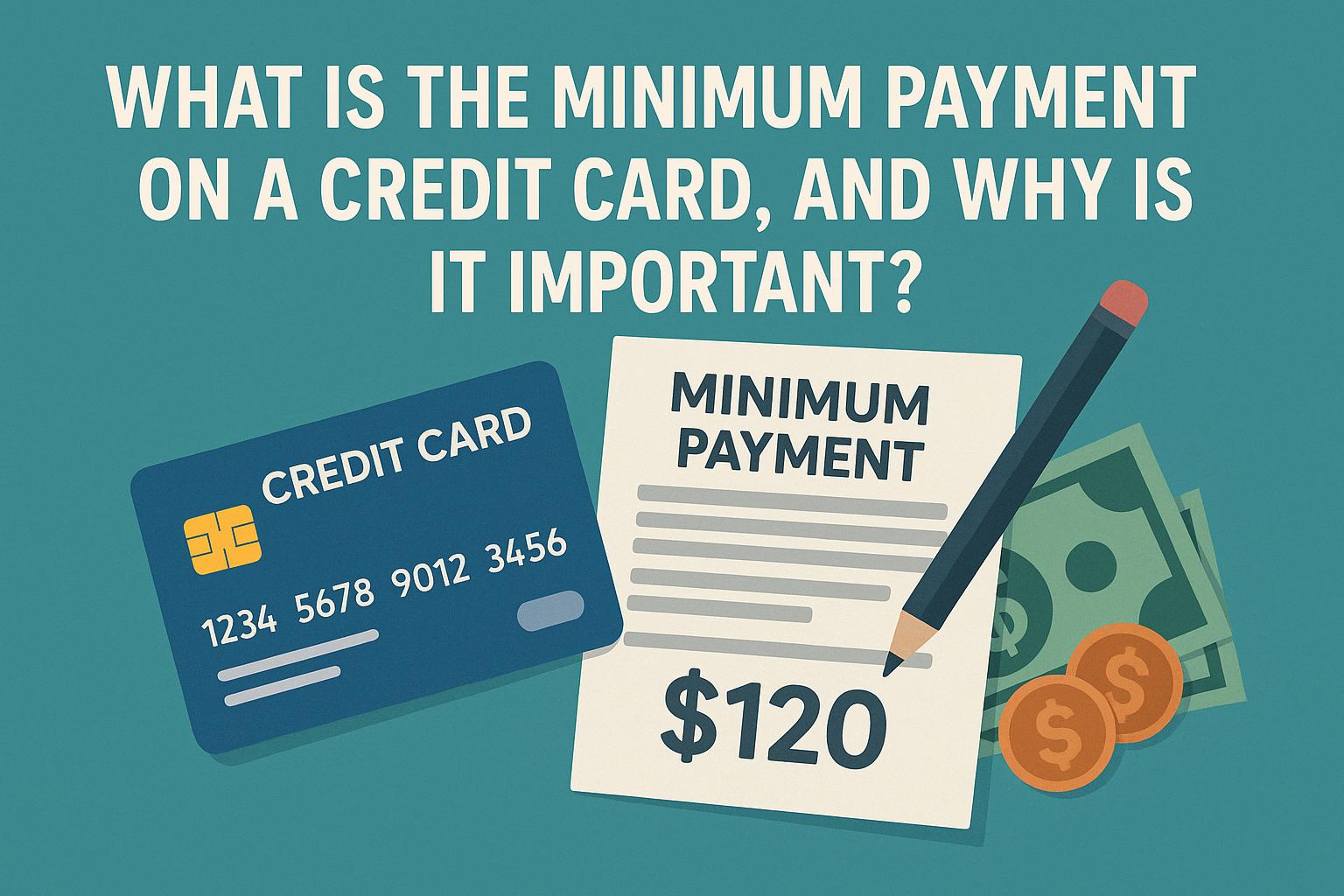

Understanding Minimum Payments on Credit Cards

When you receive your credit card statement each month, it encapsulates various crucial details that help in managing your financial matters effectively. Among these, the minimum payment stands out as a fundamental aspect of managing your credit card debt, and grasping its implications is key to maintaining financial health.

What is the Minimum Payment?

The concept of the minimum payment revolves around the notion of maintaining your credit card account in good standing. It represents the smallest sum of money that you need to settle by the designated due date. This figure is usually computed as a minor percentage of your total outstanding balance, often ranging between 1-3%. Occasionally, it might also encompass any interest charges and additional fees that have been incurred during the billing cycle.

Components of Minimum Payment

The elements constituting your minimum payment can vary based on the credit card issuer. Generally, it consists of the following:

1. A percentage of your balance: This typically accounts for 1-3% of the total outstanding balance, which includes any accrued interest and fees.

2. Any interest or fees: Including these in the minimum payments ensures that they do not compound, adding a layer of financial safety.

3. A fixed amount: Certain credit cards specify a minimum monetary amount for the payment, often around $25 to $35, irrespective of the balance.

In understanding these components, one can better navigate financial responsibilities and make informed decisions about debt management.

Why Is It Important?

Comprehending the importance of sticking to the minimum payment is vital for several reasons. Let’s delve into why this practice holds considerable weight in successfully managing credit proceedings.

Maintaining a Good Credit Score

By ensuring you pay at least the minimum amount required, your credit card stays in good standing. This consistent punctuality with payments positively influences your credit history and subsequently, your credit score. This diligence is often interpreted by financial institutions as a sign of responsible credit management, marking you as a trustworthy borrower.

Avoiding Late Fees and Penalties

Ignoring the need to make a minimum payment by the due date can trigger late fees, increased interest rates, or other punitive measures. These repercussions not only escalate the amount you owe but can also significantly diminish your credit rating over time, presenting long-term challenges.

Preventing Escalation of Debt

Although attending to the minimum payment helps shun immediate penalties, it’s crucial to realize that this approach does not significantly lower your debt. Interest continues to amass, potentially leading to a cycle of escalating debt. Making only the minimum payment each month can stretch the period required to pay off your balance, leading to a substantial increase in the total interest paid.

Additional Considerations

While meeting the minimum payment might seemingly provide a short-term respite, it’s imperative to devise a more vigorous strategy for reducing the balance over time. Consider the following strategies to manage your debt effectively:

Paying More Than the Minimum

Allocating more than the minimum payment each month helps in lowering interest costs and curtails your total debt more swiftly. It enables a proactive approach towards enhancing your financial stability and steering clear of the pitfalls of prolonged debt.

Exploring Debt Management Solutions

Exploring alternative solutions like balance transfers or consolidating debt at a lower interest rate could contribute towards more efficient debt management. These measures can offer relief and help streamline your financial obligations, paving the way for a healthier financial outlook.

By embracing these insights and strategies, you can maintain a steady course towards financial equilibrium, thereby transforming potential liabilities into opportunities for growth and management efficacy. For more tips and comprehensive advice on managing credit and enhancing financial well-being, visit the Consumer Financial Protection Bureau to access a wealth of resources and guidance.

Equipping yourself with a thorough understanding and effective management of minimum payments on credit cards can vastly improve your financial accountability and durability, ensuring a balanced and controlled financial future.